A few days ago I received an email containing an attachment of a commercial expert advisor. Ea was named CaspianEA CHF. The sender suggests that the EA is very similar to VS_EuroCross. After watching the entire of Caspian code, then obviously it is a copy of VS_EuroCross.

I must admit it seller is smart to hide his cunning. Unlike the Pip Turbo EA, CaspianEA do some things to hide that EA is just an imitation.

Changing DLL File Name

The first thing done by CaspianEA to deceive buyers is to replace Volatily Dll file be CaspianEA.CHF name. This is not a difficult thing to change the name because I also recommend if you want to run vs_eurocross on several pairs in a terminal. But look at the function used, it is clear that the version used is version before d05. But fortunately they can not change the name of the function names are used. So they actually just change the file name. And so far, although I've sold some vs_eurocross source, but for the DLL source code itself, I never give it to someone.

Changing Volatily Period Variable with Caspian Factor

This is just a trick. In principle, this variable is the period of the Moving Average, Standard Deviation and Average True Range Indicator. CaspianEA using a smaller value such as 3. However, in the code, this value will be multiplied by 10. So to use volatily period = 20, then the value Caspian Factor must use 2.

Putting indicators that are not used in any trading decisions

This is exactly the trick that fooled many traders, especially for those who do not understand the MQL language. EA sellers will say they add some indicators. But in fact, their EA does not use these indicators in any trading decisions.

Thursday, October 8, 2009

Tuesday, September 15, 2009

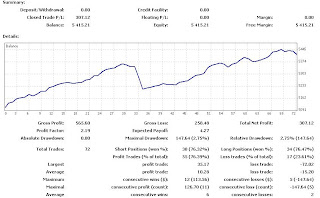

Volatily Scalp, USDJPY Expert Advisor

This is the result of optimization that I did on USDJPY pair using VS_EURCHF_D01 or Pipturbo EA. When I published Volatily Scalp EA, this pair is not included in my recommendation. I prefer to the USDCAD pair, because it backtest results from the period 2004 until February 2009 gives better result.

What's interesting about this backtest results are not used daily filter. So I set the MaxDayAtr to the greater value. I also let TradeLowRangeDay and TradeOutSideBand value with True. However, it has a limited trading time. EA will only work in 22-23 GMT +2. But in practice, based on the logic contained in EA, this means that EA work at 22-0 GMT +2. So don’t expect a lot of number of trades will be executed. And unfortunately, this is just a short back test period, which begins January 2008 until February 2009.

Label:

vs_eurchf

Monday, September 14, 2009

Variations of the Period, Entry and Exit

So far, all Volatily Scalp EA that I created is using the Moving Average as a target for the exit. In vs_eurchf and vs_eurocross I use 20 Period Moving Average while vs_eurgbp I use 50 Period Moving Average. This system will provide maximum results if the price moves only among the Upper / Lower channel and Moving Average ..

Actually, with 20 Period Moving average, we could impose the use of Upper / Lower channel as the exit. But unfortunately, it is very often if we wait for prices to penetrate Upper / lower channel, instead of profit that would come less. So when doing testing, I found an exit on the moving average is more profitable than the exit on the Upper / Lower of Keltner Channel.

10 Period Moving Average

This is slightly different if we use a shorter period, in this case 10 Period Moving Average. With a shorter period, this will increase the sensitivity of the moving average. This allows us to no longer put the Moving Average as a place of exit. However, the place for entry can be used as the exit for the opposite position.

I found the use of a shorter period would be very beneficial if used in the major pair. This is what I try to apply on USDCAD pair. Especially since I only use the shorter trading time (22-23) GMT +2, so I think it is wise to maximize the profit from each trade.

Combinations 10 and 20 Period Moving Average

Actually I was a bit hesitant to use this combination. For the first time I tried to use 2 Keltner Channels Indicator simultaneously. This provides 2 variations to place the entry.

Actually I was a bit hesitant to use this combination. For the first time I tried to use 2 Keltner Channels Indicator simultaneously. This provides 2 variations to place the entry.

The first variation, entry can be done if the price penetrates both Upper / Lower channel. To exit, we have 3 places, 10 Period Moving Average, Upper / Lower of Keltner Channel (10.1) and 20 period Moving Average.

The second variation, entry can be done if the price through the channel up / down Keltner Channel (10.1) while the distance between price and 20 Period Moving Averages is greater than 10 Period ATR. For the exit we can use as the first variation.

This method I use to pair USDCHF and USDJPY and You can see the back test results on my previous post.

Actually, with 20 Period Moving average, we could impose the use of Upper / Lower channel as the exit. But unfortunately, it is very often if we wait for prices to penetrate Upper / lower channel, instead of profit that would come less. So when doing testing, I found an exit on the moving average is more profitable than the exit on the Upper / Lower of Keltner Channel.

10 Period Moving Average

This is slightly different if we use a shorter period, in this case 10 Period Moving Average. With a shorter period, this will increase the sensitivity of the moving average. This allows us to no longer put the Moving Average as a place of exit. However, the place for entry can be used as the exit for the opposite position.

I found the use of a shorter period would be very beneficial if used in the major pair. This is what I try to apply on USDCAD pair. Especially since I only use the shorter trading time (22-23) GMT +2, so I think it is wise to maximize the profit from each trade.

Combinations 10 and 20 Period Moving Average

Actually I was a bit hesitant to use this combination. For the first time I tried to use 2 Keltner Channels Indicator simultaneously. This provides 2 variations to place the entry.

Actually I was a bit hesitant to use this combination. For the first time I tried to use 2 Keltner Channels Indicator simultaneously. This provides 2 variations to place the entry.The first variation, entry can be done if the price penetrates both Upper / Lower channel. To exit, we have 3 places, 10 Period Moving Average, Upper / Lower of Keltner Channel (10.1) and 20 period Moving Average.

The second variation, entry can be done if the price through the channel up / down Keltner Channel (10.1) while the distance between price and 20 Period Moving Averages is greater than 10 Period ATR. For the exit we can use as the first variation.

This method I use to pair USDCHF and USDJPY and You can see the back test results on my previous post.

Label:

VOLATILY SCALP

Sunday, September 13, 2009

Trading results, is there a dependency present?

This week begins with the loss derived from Eurgpb pair. But in the end these losses can be covered and still make a profit, although not as the previous week. The question whether any good results will be followed by the opposite result?

Apart from that, EA's performance was good overall, including new EA that run on USDCAD this week.

Determining Lot size

Along with the increasing number of pairs that use, the determination of risk for each pair and the EA becomes a problem. For the moment I tend to use fixed lot for EA that run on the major pairs. As for cross pair I use a fixed ratio. But from my observation, it is rarely a pair makes big profits for 2 successive days. Exceptions occur in 2 weeks ago in which a constant EURGBP pair produce a better profit than the other pair. But generally, every day the pair will produce more profit will be different.

Change lot size every day based on the performance of previous day might be an interesting idea. Since I tried VS_EurChf these characteristics have become my thought.

At the end, maybe we should learn about the z score, a statistical method to determine if there are dependencies or correlation among all our trades.

Label:

VOLATILY SCALP

Monday, September 7, 2009

Breakout System

I want to share about breakout technique which I am trying to do, so can be used as automatic trading or EA. Maybe coincidence or not, what I'm talking about here has been discussed elsewhere either in private or open in somewhere. And anyway, the contents of this post is not intended as recommendation to your daily trading. But at least this may be useful for traders who have similar interests to explore technical breakout.

Breakout Problem

A common problem encountered in making the trend following system is to avoid what is often called a whipsaw. If the entry technique is using a breakout system, the main problem of course is a false breakout. Even today generally it is easier and more common system against the entire breakout, like all of EA I share here.

Generally, to avoid the whipsaw, the developers of trading system to add various kinds of indicators that serves as a filter. For trend filter, a commonly used indicators such as the Average Directional Movement Index or ADX. Besides, the used period and Time Frame is also determining the number of whipsaw. The shorter the period and Time Frame that we used the more whipsaw, and vice versa.

There is also a breakout system developed using the European session as a filter. And as I recall one of popular EA that using this technique is Hans123. In this case it use a trading time as a filter instead of mathematical indicator.

King Keltner Strategy

Chester Keltner introduces King Keltner trading system in 1960. Chester Keltner creates a channel based on MovingAverage and added / subtracted with the Average True Range as an upper and lower channel. Specify a period of Moving Average and Average True Range. To create an Upper Channel, you add the Moving Average value with the Average True Range. To create Lower Channel subtracts the value of moving averages with the Average True Range.

This system is very simple, a buy signal occurs when prices penetrate the upper channel and sell signal occurs when prices penetrate the lower channel. Even with optimization, it is possible to make a stop Reversal System. But in general with this system, we will close all positions when prices turned back into Moving Average. One possible variation is the close only breakout. The buy and sell signals occur if the price closed above/below the channel.

Become an Automatic Trading System

With no specific rule to use the same period between the Moving Average and Average True Range, we can perform optimization on both these variables. Also we can try to optimize the deviation that we use. To reduce whipsaw, can be added ADX, and is also can be optimized. But as I said from the beginning I was not going to make this EA. Anyway you can search for this EA on the Internet; I think many are available for free.

This is just an introduction; in the next post I will explain what my observation is.

Label:

Breakout,

Keltner Channel

Friday, September 4, 2009

6% Profit During a Week

A week has passed and all my EA produces 6% profit from the Initial Balance. Of the total profit is 1 / 3 resulting from EURGBP pair. And pull it constant obtained every day for a week. Maybe if you run Scalping EA on several pairs at once, usually you will find that every day pair producing more profit will be different every day. And I think it was a good thing, because then diversification is working properly.

What about the EURCHF pair? I still think you can rely. It's just that maybe next week it my open time will shift from 19 to 20 GMT+2. This is based on the fact that often at the end of the UK session was already very low volatility and tend to increase until the closing of the American market. In the last week recorded frequently executed trading at 19 GMT +2, it gives a negative result. But I have not thought of to stop it because after all the great profit potential is still there at this hour.

For USDCHF and USDJPY pair I thought I would still use the trading time 22-23 GMT +2. Although the latest optimization shows that both pair can be traded (scalp) until 4 GMT+2. But I think in the medium term will be very volatile. But instead I will add a new pair of USDCAD. Recently I tried to add the VS_EUROCROSS Fractal indicator, and the results are good for USDCAD pair. Thus I will add this pair in my account next week.

Label:

VOLATILY SCALP

Wednesday, September 2, 2009

A good performance in 3 days

A good start is in early September. Apart from the losses at the end of last month, eventually most of the loss can be offset by profits earned in the last 3 days. This can not be separated from the good performance of the 2 pair I have just used, the USDCHF and USDJPY.

Also impressive performance was obtained from the EURGBP pair. So that it can be said that the worst results obtained from the EURCHF pair, although still positive in the end.

I give a special note to the EURGBP pair. This pair can be said to not give a meaningful contribution in the last month. But when I noticed lately, EURGBP pair is slightly more volatile than the EURCHF pair. This can be noticed before the closing session of the UK. Even the early Asian session that EURGBP volatility is still possible to get a few pips profit.

This will become more evident if we compare the daily chart for the both pair. For the EURGBP, its ATR (5) is above level 60, while EURCHF is still under level 60.

But maybe that interest is to compare the condition of the daily trend in the both pair. A question whether this is the difference? rd3etifapw

Also impressive performance was obtained from the EURGBP pair. So that it can be said that the worst results obtained from the EURCHF pair, although still positive in the end.

I give a special note to the EURGBP pair. This pair can be said to not give a meaningful contribution in the last month. But when I noticed lately, EURGBP pair is slightly more volatile than the EURCHF pair. This can be noticed before the closing session of the UK. Even the early Asian session that EURGBP volatility is still possible to get a few pips profit.

This will become more evident if we compare the daily chart for the both pair. For the EURGBP, its ATR (5) is above level 60, while EURCHF is still under level 60.

But maybe that interest is to compare the condition of the daily trend in the both pair. A question whether this is the difference? rd3etifapw

Label:

VOLATILY SCALP

Tuesday, September 1, 2009

Scalping And Volatility

I think August is the month that EA is not profitable for me. Right in the last week in August was EA I experienced considerable Drawdown. As a result the loss of 75% of the profits that have been obtained from the beginning of the month.

Perhaps this is the accumulation of the low volatility of current. When the market was in a low volatility, the possibility for a change (increasing) to the greater volatility. Actually I've noticed this situation since the beginning. As the UK towards the end of the session, the market does not show impulsive movement. Finally, Impulsive movements result in the end it started the American session. Fortunately the price corrected more than half, so that greater losses can be avoided.

I personally hope this is a sign will be a change in Day-to-day volatility of the next. Although not in the short term, at least those changes may be seen in this month. Ideally for scalping system in the Asian session, at least ATR (20) are not under 6. And to achieve that level condition, at least daily range should be above 75 pips.

Perhaps this is the accumulation of the low volatility of current. When the market was in a low volatility, the possibility for a change (increasing) to the greater volatility. Actually I've noticed this situation since the beginning. As the UK towards the end of the session, the market does not show impulsive movement. Finally, Impulsive movements result in the end it started the American session. Fortunately the price corrected more than half, so that greater losses can be avoided.

I personally hope this is a sign will be a change in Day-to-day volatility of the next. Although not in the short term, at least those changes may be seen in this month. Ideally for scalping system in the Asian session, at least ATR (20) are not under 6. And to achieve that level condition, at least daily range should be above 75 pips.

Label:

VOLATILY SCALP

New Expert Advisor

I've made an EA. Still incomplete, but at least my backtest results do quite encouraging, at least for the last 1 year. EA is working on the USDCHF pair and just do trading at 22-23 hours GMT +2. Nevertheless my backtest results on USDJPY pair also gives good results although there is a greater drawdown.

New EA

And it turned out with little change in my vs_eurocross can also get a satisfactory result on the both pairs. I change volatility period to 10, and set a maximum trade per position to be 2 and maximum trades per bar to 1. As for the use of indicators ck_speed speed is limited to 1. (Yellow).

VS_eurocross backtest on usdchf

VS_EuroCross on USDJPY

Especially for USDJPY pair, my backtest results using vs_eurchf_d01 or pipturbo, by limiting the trading hours of time at 22-23 GMT +2 also gives good results.

Thus, at this point I added 4 EA and into my account using 3 difference EA.

And it turned out with little change in my vs_eurocross can also get a satisfactory result on the both pairs. I change volatility period to 10, and set a maximum trade per position to be 2 and maximum trades per bar to 1. As for the use of indicators ck_speed speed is limited to 1. (Yellow).

Especially for USDJPY pair, my backtest results using vs_eurchf_d01 or pipturbo, by limiting the trading hours of time at 22-23 GMT +2 also gives good results.

Thus, at this point I added 4 EA and into my account using 3 difference EA.

Label:

VOLATILY SCALP

Tuesday, August 25, 2009

Finding Best Time to Scalp Major Pair

I start my job again making trading system for major pair. This system is still working on a particular clock hour. For that I tried to dig up from some other popular EA, see the tendency at any hour they work.

I find generally brief EA is working on a range of time shorter than the EA is working on Cross Pair. This makes the number of trades executed may be very little. This coupled with the fact that they generally only work 4 days a week. The effect recovery factor will be a long time, when the EA suffering draw down.

Interestingly most of the EA is able to work in more than one pair at a time, either by using the same variable or different. Unfortunately one of the fundamental weaknesses that are owned by the Meta Trader is that we can not do backtest on more than one pair. So we can not determine whether it is more profitable or not. Diversification effects may not work properly as expected.

As a preliminary conclusion, I see that most of us will get a good backtest results if we restrict the EA to work on the 21-23 or 20-23 hours GMT +2. This is not foreign to me, because when I make VS_EurCHF, for the pair EURUSD, the profit factor increases if the trading time is limited to 20-1 GMT +2.

I tend to wish to make my EA is able to work as well as with the Cross pair. However, until now, I must admit, that forced to work like that cause suffering Account large draw down. Until now I was thinking to try some exit strategy. With a small amount of trade, should be made to maximize any existing trade instead of just scalp it.

I find generally brief EA is working on a range of time shorter than the EA is working on Cross Pair. This makes the number of trades executed may be very little. This coupled with the fact that they generally only work 4 days a week. The effect recovery factor will be a long time, when the EA suffering draw down.

Interestingly most of the EA is able to work in more than one pair at a time, either by using the same variable or different. Unfortunately one of the fundamental weaknesses that are owned by the Meta Trader is that we can not do backtest on more than one pair. So we can not determine whether it is more profitable or not. Diversification effects may not work properly as expected.

As a preliminary conclusion, I see that most of us will get a good backtest results if we restrict the EA to work on the 21-23 or 20-23 hours GMT +2. This is not foreign to me, because when I make VS_EurCHF, for the pair EURUSD, the profit factor increases if the trading time is limited to 20-1 GMT +2.

I tend to wish to make my EA is able to work as well as with the Cross pair. However, until now, I must admit, that forced to work like that cause suffering Account large draw down. Until now I was thinking to try some exit strategy. With a small amount of trade, should be made to maximize any existing trade instead of just scalp it.

Label:

Trading Time,

VOLATILY SCALP

Wednesday, August 19, 2009

Expert Advisor Performance Hourly

I think we should be grateful to Mt4stats which has developed a variety of features it has, so we get a better picture of how the performance of an expert advisor. The entire feature is currently not possible we will get in the Meta Trader Detailed Statement. The most concrete example is we can analyze the performance of expert advisor hourly. This is very useful for us to run the expert advisor who works only on at certain hours. Here is current performance on Alpari Russia demo server.

If we consider the graph above, then we will have a picture of what hours on the expert advisors that produce more profit than the other hours. For plasticity at this time that most of the profit obtained on days 18 and 22 (19 and 23 GMT +2). Based on this information, we can see that the open hours for the best at this time are 19 and 23 or 19 and 22(GMT +2). But back at any time that this condition could be changed. However, this is the most close to the current market condition.

If we consider the graph above, then we will have a picture of what hours on the expert advisors that produce more profit than the other hours. For plasticity at this time that most of the profit obtained on days 18 and 22 (19 and 23 GMT +2). Based on this information, we can see that the open hours for the best at this time are 19 and 23 or 19 and 22(GMT +2). But back at any time that this condition could be changed. However, this is the most close to the current market condition.

Label:

Trading Time,

VOLATILY SCALP

Monday, August 17, 2009

Keltner Channel and Bollinger Band

When I learn about Average True Range and Standard Deviation indicator, I find it interesting when put Keltner Channel and Bollinger Band together on a chart. As we know, that the Keltner Channel is made from a combination of Moving Average and Average True Range. And Bollinger Band is combination of Moving Average and Standard Deviation.

What's interesting my attention when Bollinger Band (20.2) is located inside the Keltner Channel. (20.1). This is a technical condition which is very appropriate to describe the market conditions are in the sideway. Moving Average is located right in the middle chart. Support and resistance are on the right Bollinger Band. Unfortunately, often in a situation like this, the price Range doesn’t allow us to make profitable trades. Especially with the wide spread condition plus the possibility of getting slippage when taking and liquidating a position.

However, the longer market in the situation likes this, and then will be going to the big new trend. Possibility of profit that we get, can be lost quickly when the breakout occurred.

What's interesting my attention when Bollinger Band (20.2) is located inside the Keltner Channel. (20.1). This is a technical condition which is very appropriate to describe the market conditions are in the sideway. Moving Average is located right in the middle chart. Support and resistance are on the right Bollinger Band. Unfortunately, often in a situation like this, the price Range doesn’t allow us to make profitable trades. Especially with the wide spread condition plus the possibility of getting slippage when taking and liquidating a position.

However, the longer market in the situation likes this, and then will be going to the big new trend. Possibility of profit that we get, can be lost quickly when the breakout occurred.

Label:

Keltner Channel,

VOLATILY SCALP

Wednesday, August 12, 2009

Lose by slippage

Since the possibility to set the minimum range for executing trade, we must realize that in real live trading we will fight with slippage. Forcing expert adivisor to close profitable trade with just one pip may look amazing in back test result. Unfortunately we can't perform slippage simulation during backtest. Generally each backtest result should be recalculated by reducing all profitable trade with slippage, as well adding losing trades by slippage.

Now let we make backtest using fixed lot. At the end of backtest we could see average profit in pips by converting average profit in money with pips value. How many pips our average profit in pips?

Scalping definition by brokers

Mostly in the Term of Service and Term of Condition every brokers tell about scalping method. Generally its about time and profit. No closing trade before x minutes or no closing trade less then x pips. Violate this rule can cancel all our winning trade and of course not for losing trade. We can still follow this rule however. In the other hand some broker will warn us if we executed xx trades in short period. For this kind of rule, we should consider finding another broker.

Monday, August 10, 2009

Exploiting Low Volatility

At the decent time most of trades executed during 19-23 GMT+2 only. After that time often just one trade can be executed. With the possibility to set the minimum range we can exploit this low volatility. I change my set for 22-05 trading time. For the last 2 days, I don't use spread filter during this time. I set my min range to 1 and let my min profit to 2.

VS_EurChf Optimization

Actually optimizing VS_EurChf is more simple then vs_eurocross. Mostly you just need to optimize the trading time and stoploss. To get higher profit ratio then reduce maxtrade value. If you are optimizing on Mayor pair then you should always set TradeLowRangeDay to False as well tradeoutsideband. On the other hand, you set both variables to True on cross pair. rd3etifapw

Keep the robustness of your optimization. Every time you get satisfaction result on mayor pair, then test it on other mayor pair and it should be profitable. The result should be also profitable on cross pair.

Label:

VOLATILY SCALP

Sunday, August 9, 2009

VS_EuroCross_D05 Update

I have fixed the wrong statement as my previous post. Now you can update your VS_EuroCross_D05. However it's not including the new FFCAL indicator.

I also expect if your are newbies to Meta Trader platform, then find guidance from other site. Although in the next future i will post about MQL4 programming and EA installation guide. And if you are newbies to use my Expert Advisor, then please read my old post if you don't find any answer in the manual.

My Recent Activities

At the moment I still build the VS_EuroCross without using ActiveX. May be is sound weird, but its true. Since publishing my VS_EuroCross with using ActiveX, I never update it original source, and all my demo test also using what you download from my 4shared folder.

Preparing for Market Change

On my own observation, every year during August to December, the volatility will increase, and often market in trending way. Refer to last year performance, during this period is a heaven for any scalper EA that work in Asian Session. Will be repeated? No one can answer it. However during high volatility my EA will trade often. Thus if this happen reduce your risk, and expect bigger profit from more pips that EA earn instead of increasing your trade size.

I also expect if your are newbies to Meta Trader platform, then find guidance from other site. Although in the next future i will post about MQL4 programming and EA installation guide. And if you are newbies to use my Expert Advisor, then please read my old post if you don't find any answer in the manual.

My Recent Activities

At the moment I still build the VS_EuroCross without using ActiveX. May be is sound weird, but its true. Since publishing my VS_EuroCross with using ActiveX, I never update it original source, and all my demo test also using what you download from my 4shared folder.

Preparing for Market Change

On my own observation, every year during August to December, the volatility will increase, and often market in trending way. Refer to last year performance, during this period is a heaven for any scalper EA that work in Asian Session. Will be repeated? No one can answer it. However during high volatility my EA will trade often. Thus if this happen reduce your risk, and expect bigger profit from more pips that EA earn instead of increasing your trade size.

Label:

VS_EUROCROSS

Friday, August 7, 2009

Difference formula for buy and sell signal

There is a single line in my VS_EuroCross_D05 that should be corrected. I forget to link it with the external variable. It make your optimization will not work on long position. However in the short position it work well, as well if your broker offer 3 fixed spread and you use default setting.

It is located on the line 419 setFilter2(currange,3,1,0,0), all these parameter should be linked in the external variable. It is over optimization. Because the entry formula for long position is different with short position. To fix it, just go to the line 398, or find this statement setFilter2(currange,MinRange,MinProfit,UseRange,UseTradeRange) then replace it. This is the correct one. For a system, the Sell signal and Buy signal should be symmetrical.

Sponsor link:

MSI U123 10.2” XP Home 3-Cell Netbook (Blue or Red) $319 Free Shipping

Reduce Your Spread at Many Forex Broker

It is located on the line 419 setFilter2(currange,3,1,0,0), all these parameter should be linked in the external variable. It is over optimization. Because the entry formula for long position is different with short position. To fix it, just go to the line 398, or find this statement setFilter2(currange,MinRange,MinProfit,UseRange,UseTradeRange) then replace it. This is the correct one. For a system, the Sell signal and Buy signal should be symmetrical.

Sponsor link:

MSI U123 10.2” XP Home 3-Cell Netbook (Blue or Red) $319 Free Shipping

Reduce Your Spread at Many Forex Broker

Label:

VS_EUROCROSS

Thursday, August 6, 2009

VS_EuroCross_D05 Will Become The Last Version

Although the VS_EuroCross_D05 is the last version of VS_EuroCross, but still it has some problems that I can't fix it.

The Trading Time

Unfortunately until now the trading time problem in VS_EuroCross_D05 is not fixed yet. This problem is regarding to the rule no trade in the first 2 hours at weekly opening. In simple world no trade before Monday 0 GMT+0 every weekly opening. Thus if you can't match this rule with your broker, then it is better just avoid trading during this time.

Running more then one VS_EuroCross_d05 in a platform

According to Mq4 reference, that all Dynamic Link Library file is shared to all EA in the platform. Unfortunately this is make VS_EuroCross unstable if your run it on several chart at once. However you can do little trick if you keep going to run it on several charts at your MetaTrader Platform. If you already copy the volatily.dll in your library folder, then simply copy again that file and give it difference name, such as volatily1.dll; Next you need to change the import statement in the mq4 source file. Just find this statement #impor volatily.dll and rename the volatily.dll with volatily1.dll; You can do this step as much as you want. However you have to be wise regarding the performance. You should only do this thing in your demo account.

The FFCal Indicator

Regarding the FFCal version which is included in my package file,please visit fx-knight.com to get the latest version.

Because of scalping is a high cost game, you may need to find such rebate program to minimize your cost. However you may not always get rebate by the Term of Service or Term of Condition from the broker. But the end it would be better to try it.

Sponsor link:

MSI U123 10.2” XP Home 3-Cell Netbook (Blue or Red) $319 Free Shipping

Reduce Your Spread at Many Forex Broker

The Trading Time

Unfortunately until now the trading time problem in VS_EuroCross_D05 is not fixed yet. This problem is regarding to the rule no trade in the first 2 hours at weekly opening. In simple world no trade before Monday 0 GMT+0 every weekly opening. Thus if you can't match this rule with your broker, then it is better just avoid trading during this time.

Running more then one VS_EuroCross_d05 in a platform

According to Mq4 reference, that all Dynamic Link Library file is shared to all EA in the platform. Unfortunately this is make VS_EuroCross unstable if your run it on several chart at once. However you can do little trick if you keep going to run it on several charts at your MetaTrader Platform. If you already copy the volatily.dll in your library folder, then simply copy again that file and give it difference name, such as volatily1.dll; Next you need to change the import statement in the mq4 source file. Just find this statement #impor volatily.dll and rename the volatily.dll with volatily1.dll; You can do this step as much as you want. However you have to be wise regarding the performance. You should only do this thing in your demo account.

The FFCal Indicator

Regarding the FFCal version which is included in my package file,please visit fx-knight.com to get the latest version.

Because of scalping is a high cost game, you may need to find such rebate program to minimize your cost. However you may not always get rebate by the Term of Service or Term of Condition from the broker. But the end it would be better to try it.

Sponsor link:

MSI U123 10.2” XP Home 3-Cell Netbook (Blue or Red) $319 Free Shipping

Reduce Your Spread at Many Forex Broker

Label:

VS_EUROCROSS

Entry Setup

I grab the picture today that showing how VS_EuroCross_D05 trigger the trade with new entry rule (UseTradeRange=true). As common rule in my Volatily Scalp EA that to trigger entry the distance between price and MA must be equal or more then signal filter. The signal filter itself is comparable the maximum between double spread and current 20 Average True Range. Applying this rule will guarantee if price hit the MA at the same bar when it triggered, we will make profit as much as current spread or even more, in case the current ATR is bigger then double spread.

Back to new entry rule, it is now calculate the current range. If the current range is bigger then Signal Filter, the entry will be triggered if the distance between price and MA is equal or bigger then spread + 1 pip. But still it must penetrate upper/lower Keltner Channel. Mostly during low volatility, if the price penetrate upper/lower channel while current range is bigger then double 20 Period ATR, price will back to Moving Average.

UseTradeRange Signal

Acer Aspire One Ultra Thin AOD250-1116 10.1” Atom 1.6GHz XP Home Red Netbook $271.99 Free Shipping

Back to new entry rule, it is now calculate the current range. If the current range is bigger then Signal Filter, the entry will be triggered if the distance between price and MA is equal or bigger then spread + 1 pip. But still it must penetrate upper/lower Keltner Channel. Mostly during low volatility, if the price penetrate upper/lower channel while current range is bigger then double 20 Period ATR, price will back to Moving Average.

Acer Aspire One Ultra Thin AOD250-1116 10.1” Atom 1.6GHz XP Home Red Netbook $271.99 Free Shipping

Label:

VS_EUROCROSS

Wednesday, August 5, 2009

Variable Optimization

What make me enjoy with VS_EuroCross_D05 that it is more profitable with any previous version just using single trade per position. If you would like to optimize this VS_EuroCross_D05, try to optimize the MinRange and MinProfit variable. In this case you should set the SpreadFilter to false. You can apply UseTradeRange and UseRange after finding suitable result, other way you can directly to optimize those variables.

I made 2 back test before releasing VS_EuroCross_D05. The first back test just to set UseTradeRange Variable with True, and the second I set the MinProfit with 2.

UseTradeRange True

MinTarget True

I made 2 back test before releasing VS_EuroCross_D05. The first back test just to set UseTradeRange Variable with True, and the second I set the MinProfit with 2.

Label:

External Variable,

VS_EUROCROSS

Tuesday, August 4, 2009

FFCAL Indicator Setup

Since VS_EuroCross_D05 come with FFCAL Indicator, I add some external variables to use FFCAL Indicator. In VS_EuroCross_D05, the use of FFCAL indicator is integrated in the trading time function. As the news filter, the main thing that you have to do is deciding minutes for news before and after.

Below the list of external variable that you have to set to use FFCAL indicator. However please remember that VS_EuroCross_D05 comes with 2 MQ4 files, VS_EuroCross_D05.Mq4 and VS_EuroCross_D05_NonFFCal.Mq4.

extern bool NewsFilter =false;

It is the first thing that you have to change. Set its value to True to use FFCAL indicator.

extern int MinBeforeNewsCloseAction=15;

Set the minutes before news for closing all open positions. Default value is 15 minutes.

extern int MinBeforeNewsNoTrade=60;

Set the minutes before news to tell expert stop executing any trade.

extern int MinAfterNewsToTrade=120;

Set the minutes after news to allow expert execute a trade.

extern bool IncludeMediumImpact=false;

Including medium impact news or not.

However you can't filter out the news by its Country.

Below the list of external variable that you have to set to use FFCAL indicator. However please remember that VS_EuroCross_D05 comes with 2 MQ4 files, VS_EuroCross_D05.Mq4 and VS_EuroCross_D05_NonFFCal.Mq4.

extern bool NewsFilter =false;

It is the first thing that you have to change. Set its value to True to use FFCAL indicator.

extern int MinBeforeNewsCloseAction=15;

Set the minutes before news for closing all open positions. Default value is 15 minutes.

extern int MinBeforeNewsNoTrade=60;

Set the minutes before news to tell expert stop executing any trade.

extern int MinAfterNewsToTrade=120;

Set the minutes after news to allow expert execute a trade.

extern bool IncludeMediumImpact=false;

Including medium impact news or not.

However you can't filter out the news by its Country.

Label:

VS_EUROCROSS

Monday, August 3, 2009

VS_EuroCross_d05 External Variables

Below the list of new external variables that are used in VS_EuroCross_D05.

extern double MinRange =3

Unlike any previous version, now we can use flexible range (distance from MA) to execute the trade. Inside the code, this value will be added with current spread. Thus this is just equal with double spread (Spread on my backtest is 3).

extern bool SpreadFilter=true

If you want to keep using double spread filter, then just set this variable to True.

extern double MinProfit =1

It doesn't mean if you set this variable with 1, then expert will close any orders with 1 pip profit. But since most profitable trades are closed when price hits MA, then the expert will see this variable when price hit MA. Thus if you pay for commission, set this value with 2.

extern bool UseRange =false

Basically it just calculate current range. Set this value to True. My backtest shows better result by using this filter.

extern bool UseTradeRange=false;

I set this value to True, when posting VS_EuroCross_D05 backtest result. Just compare between with FixedTP, the profit factor is equal but VS_EuroCross_D05 has bigger profit then FixedTP.

extern double MinRange =3

Unlike any previous version, now we can use flexible range (distance from MA) to execute the trade. Inside the code, this value will be added with current spread. Thus this is just equal with double spread (Spread on my backtest is 3).

extern bool SpreadFilter=true

If you want to keep using double spread filter, then just set this variable to True.

extern double MinProfit =1

It doesn't mean if you set this variable with 1, then expert will close any orders with 1 pip profit. But since most profitable trades are closed when price hits MA, then the expert will see this variable when price hit MA. Thus if you pay for commission, set this value with 2.

extern bool UseRange =false

Basically it just calculate current range. Set this value to True. My backtest shows better result by using this filter.

extern bool UseTradeRange=false;

I set this value to True, when posting VS_EuroCross_D05 backtest result. Just compare between with FixedTP, the profit factor is equal but VS_EuroCross_D05 has bigger profit then FixedTP.

Label:

External Variable,

VS_EUROCROSS

Sunday, August 2, 2009

VS_EuroCross_D05 Now Available

Finally, its done. You can download my VS_EuroCross_D05 which is coming without expiration time. This version also including FFCal news indicator that use ForexFactory calendar event. It also back to previous version setting, that VS_EuroCross_D02, except the VisibleTP.

As usual every updating will be followed by new external variable, you will find much more in this version. It is just not because the new FFCal Indicator, but also some internal variable in the previous version become external variable right now. Thus I expect you refer to VS_EuroCross_D03,VS_EuroCross_D04,FixedTP to track the change.

You will find 2 mq4 files in the package, one use FFCal indicator and the other doesn't. It will help you to make backtest, because if you use FFCal in your backtest, may be you will find a huge error message in your journal. It may occur if you make backtest while offline, or the indicator didn't get yet its data from ForexFactory.

Backtest Result

Every Backtest that I post here is using Apari historical data, with spread condition is 3. Mostly I use January 01, 2007 as beginning period and February, 2009 as ending period. However you can visit Vrtrader blog, that provide backtest result year by year since 1999, and thanks for his great job.

Anyway I will provide any new variable in the next post, and hope you can test it by your self at the moment. Also please read in the source code, I give some notes for your guidance for optimization.

As usual every updating will be followed by new external variable, you will find much more in this version. It is just not because the new FFCal Indicator, but also some internal variable in the previous version become external variable right now. Thus I expect you refer to VS_EuroCross_D03,VS_EuroCross_D04,FixedTP to track the change.

You will find 2 mq4 files in the package, one use FFCal indicator and the other doesn't. It will help you to make backtest, because if you use FFCal in your backtest, may be you will find a huge error message in your journal. It may occur if you make backtest while offline, or the indicator didn't get yet its data from ForexFactory.

Backtest Result

Every Backtest that I post here is using Apari historical data, with spread condition is 3. Mostly I use January 01, 2007 as beginning period and February, 2009 as ending period. However you can visit Vrtrader blog, that provide backtest result year by year since 1999, and thanks for his great job.

Anyway I will provide any new variable in the next post, and hope you can test it by your self at the moment. Also please read in the source code, I give some notes for your guidance for optimization.

Label:

VS_EUROCROSS

Friday, July 31, 2009

VS_EuroCross_D05 Available on August 2, 2009

I have to apologize because you have to wait until August 2, 2009 for downloading VS_EuroCross_D05. I just finished to build this version, but still little modification is needed. However I have already made backtest, and you can compare with my previous backtest. It is same result with FixedTP version. Only there is a significant difference with previous version, at this version I use spread + n pips formula instead of double spread, and the last it become external variable.

This change make incompatibility with any previous mql version. But seem it still possible to make flexibility using spread + n pips formula or double spread.

This change make incompatibility with any previous mql version. But seem it still possible to make flexibility using spread + n pips formula or double spread.

Label:

VS_EUROCROSS

Tuesday, July 28, 2009

VS_EuroCross_D05 will be available before August

I have lose my latest work, but seem I can start again and complete it before August. However if I fail to complete this version, then the FixedTP version become VS_EuroCross_D05 just it will come without time expiration.

Label:

VS_EUROCROSS

Wednesday, July 22, 2009

How to Choose a Broker

I run my demo again today rd3etifapw. I decide to use NordMarkets to run VS_EuroCross (FixedTP). I use the same setting with my previous forward test on Tadawul. There is a significant difference in EurGbp Spread at NordMarkets. It offer 2 fixed pip spread.

It doesn't mean i give a recomendation to use this broker to run my EA. Its only cause I see that seem it price movement close to real feed.

However if you are looking for a good broker to run my EA, then just look their liquidity in the Asian Session. Compare several broker real feed, your first attention to find the highest true range (20 Period ATR). Mostly you will find the broker with 5 digits has higher range then 4 digit broker. Next look their spread. Its good if you can find a fixed spread broker that their spread is less then 5.

ECN Broker

It seem a hard one to find low fixed spread broker and looking ECN broker is the best one. ECN offer floating spread (low) according to market liquidity and mostly give another transaction cost. Thus we pay for commission and spread. If you decide to use ECN broker then make sure their commission is less then 1 pip value per trade size. This is important because my EA calculates the profit in pip. I ever find a broker with really good feed and execution. It has higher liquidity then others broker during trading time. But I forget to calculate their stupid commission. Its equal to 5 pip! Sick. My EA can make 7 positive transactions, but all become negative, because it just 4 pips profit per trade.

Requote

Requote is another aspect that you must think before using a broker. Unfortunately we must trade in real to know it. There is no other way to know how good their execution except to test it directly.

It doesn't mean i give a recomendation to use this broker to run my EA. Its only cause I see that seem it price movement close to real feed.

However if you are looking for a good broker to run my EA, then just look their liquidity in the Asian Session. Compare several broker real feed, your first attention to find the highest true range (20 Period ATR). Mostly you will find the broker with 5 digits has higher range then 4 digit broker. Next look their spread. Its good if you can find a fixed spread broker that their spread is less then 5.

ECN Broker

It seem a hard one to find low fixed spread broker and looking ECN broker is the best one. ECN offer floating spread (low) according to market liquidity and mostly give another transaction cost. Thus we pay for commission and spread. If you decide to use ECN broker then make sure their commission is less then 1 pip value per trade size. This is important because my EA calculates the profit in pip. I ever find a broker with really good feed and execution. It has higher liquidity then others broker during trading time. But I forget to calculate their stupid commission. Its equal to 5 pip! Sick. My EA can make 7 positive transactions, but all become negative, because it just 4 pips profit per trade.

Requote

Requote is another aspect that you must think before using a broker. Unfortunately we must trade in real to know it. There is no other way to know how good their execution except to test it directly.

Label:

VOLATILY SCALP

Tuesday, July 21, 2009

I Stop My Test

I already stop my forward test on TadawulFX. The data feed on EurGbp is very difference with actual price and unacceptable. However it show us the useful of showing our target. But if you want to compare between your demo on other broker with Tadawul, then here the login 999333047 and password bxr3kqr of demo account.

I run 3 vs_eurocross on this demo account, 2 on EURCHF pair and the rest on EURGBP. Since last week I use the FixedTP version.

Set 1:EURCHF

OpenHour=19;

CloseHour=23;

Risk=25;

UseAtrMod=true;

MyOwnTarget=5;

VisibleTP=True;

Set 2:EURCHF

OpenHour=22;

CloseHour=05;

Risk=25;

UseAtrMod=true;

MyOwnTarget=5;

VisibleTP=True;

set 3: EURGBP

OpenHour=19;

CloseHour=23;

Risk=25;

UseAtrMod=true;

MyOwnTarget=5;

VisibleTP=True;

Others setting is default for all sets. Trading hour is GMT+2.

I run 3 vs_eurocross on this demo account, 2 on EURCHF pair and the rest on EURGBP. Since last week I use the FixedTP version.

Set 1:EURCHF

OpenHour=19;

CloseHour=23;

Risk=25;

UseAtrMod=true;

MyOwnTarget=5;

VisibleTP=True;

Set 2:EURCHF

OpenHour=22;

CloseHour=05;

Risk=25;

UseAtrMod=true;

MyOwnTarget=5;

VisibleTP=True;

set 3: EURGBP

OpenHour=19;

CloseHour=23;

Risk=25;

UseAtrMod=true;

MyOwnTarget=5;

VisibleTP=True;

Others setting is default for all sets. Trading hour is GMT+2.

Label:

problem,

VOLATILY SCALP

Monday, July 20, 2009

A week before updating

As I have stated before that the next version (D05) will be unlimited one, and may be in the short period there is no more any change after that. The version will be release as usual on 27 July or before 1s August 2009.

The FixedTP version is the base of D05 version. Also as I stated before about possibility to use new Indicator, but seem i will not use it the next version. Right now i just think to add news filter because this task is always appear every month.

About Selling My Source Code

I think there is a misunderstanding regarding this issue. It seem i will force you to buy (donate) to get the next version. No, absolutely its a wrong perception. In fact I will release D05 without time expiration as usual in previous version.

What I sell is my VS_EUROCROSS without using activex file. I give you a choice to use unexpired VS_EuroCross with activex version, or to buy the source vs_eurocross without using dll. GPL license will guarantee you can modify my source and resell it, but you have also give your source to your buyer. Term Free is the freedom to get and modify the source code. Other wise you can modify and never sharing your modification if you don't want to share your source.

Anyway if you have another option then you can also contact me to see if we can make agreement.

The FixedTP version is the base of D05 version. Also as I stated before about possibility to use new Indicator, but seem i will not use it the next version. Right now i just think to add news filter because this task is always appear every month.

About Selling My Source Code

I think there is a misunderstanding regarding this issue. It seem i will force you to buy (donate) to get the next version. No, absolutely its a wrong perception. In fact I will release D05 without time expiration as usual in previous version.

What I sell is my VS_EUROCROSS without using activex file. I give you a choice to use unexpired VS_EuroCross with activex version, or to buy the source vs_eurocross without using dll. GPL license will guarantee you can modify my source and resell it, but you have also give your source to your buyer. Term Free is the freedom to get and modify the source code. Other wise you can modify and never sharing your modification if you don't want to share your source.

Anyway if you have another option then you can also contact me to see if we can make agreement.

Label:

VOLATILY SCALP

Sunday, July 19, 2009

VS_EuroCross_D05 will be unlimited

After more then 4 months forward testing, may be the next release of my VS_EUROCROSS will be unlimited version. I will stop for a while any improvement of this version. As exchanged I will finish my others EA or begin migrating this version to another platform, such as Dukascopy.

I Will Sell The (MQL4) Source of VS_EUROCROSS

I have stated in my VS_EurChf that my main business is selling the source code. I just shared the compiled version of my EA with or without time expiration and expecting donation from your profit that made by my EA. May be this is my general answer for all who ever asking me about sharing the mql4 version instead of using the Activex. It make me more confidence to state selling source code instead of saying selling Expert Advisor.

If you can accept the GPL licenses and want to pay for 500$ to get the copy, I will wait a minimum 100 offers before accepting all your offers. Thus mail me at volatily@gmail.com if you want to purchase it, and do not send any money to my PayPal account before i give you notification to send your payment.

Perhaps from this income can improve this blog, and may be next time all forward test in this blog will use real account, and therefore will give more confidence before using my EA in your real account.

However if you use my Activex version, i still expecting donation if you made profit as my general term in sharing my EA.

I Will Sell The (MQL4) Source of VS_EUROCROSS

I have stated in my VS_EurChf that my main business is selling the source code. I just shared the compiled version of my EA with or without time expiration and expecting donation from your profit that made by my EA. May be this is my general answer for all who ever asking me about sharing the mql4 version instead of using the Activex. It make me more confidence to state selling source code instead of saying selling Expert Advisor.

If you can accept the GPL licenses and want to pay for 500$ to get the copy, I will wait a minimum 100 offers before accepting all your offers. Thus mail me at volatily@gmail.com if you want to purchase it, and do not send any money to my PayPal account before i give you notification to send your payment.

Perhaps from this income can improve this blog, and may be next time all forward test in this blog will use real account, and therefore will give more confidence before using my EA in your real account.

However if you use my Activex version, i still expecting donation if you made profit as my general term in sharing my EA.

Label:

VS_EUROCROSS

Thursday, July 16, 2009

Redownload My FixedTP Version

There are two wrong statement in the previous:

double sf=MathMax(sf,arratr[0]/mypoint);//line 751

It should be double sf=MathMax(sp,arratr[0]/mypoint);

isModBuy=OrderModify(OrderTicket(),OrderOpenPrice(),OrderOpenPrice()+StopLoss*mypoint,GetOptimalTP(Magic,OP_SELL),0,Red);//line 797

It should be:

isModSell=OrderModify(OrderTicket(),OrderOpenPrice(),OrderOpenPrice()+StopLoss*mypoint,GetOptimalTP(Magic,OP_SELL),0,Red);//line 797

double sf=MathMax(sf,arratr[0]/mypoint);//line 751

It should be double sf=MathMax(sp,arratr[0]/mypoint);

isModBuy=OrderModify(OrderTicket(),OrderOpenPrice(),OrderOpenPrice()+StopLoss*mypoint,GetOptimalTP(Magic,OP_SELL),0,Red);//line 797

It should be:

isModSell=OrderModify(OrderTicket(),OrderOpenPrice(),OrderOpenPrice()+StopLoss*mypoint,GetOptimalTP(Magic,OP_SELL),0,Red);//line 797

Label:

VS_EUROCROSS

Best Performance

I think this is the best performance from VS_EUROCROSS since d01.

EurGbp trading time 19-23

EurGbp trading time 19-23

Eurchf Trading Time 22-05

Eurchf Trading Time 22-05

Eurchf Trading Time 19-23

Eurchf Trading Time 19-23

EurGbp trading time 19-23

EurGbp trading time 19-23 Eurchf Trading Time 22-05

Eurchf Trading Time 22-05 Eurchf Trading Time 19-23

Eurchf Trading Time 19-23

Label:

VS_EUROCROSS

Wednesday, July 15, 2009

Showing The Target (New Update)

I add another feature to VS_EUROCROSS that allowing EA to show its target. On my experience during last two weeks, it seems the Expert suffered too much slippage. This is especially when Expert holds more then 1 positions and tries to close all position at once.

What I see if price make up down move within 6 pips will make EA react and often EA will get requote. After make several test finally I can add this feature to VS_EUROCROSS without affecting all the exit rules.

POSSIBLE PROBLEM IN LIVE TRADE

Although backtest show there is no much difference when using fixed target (I am not sure but its looked better), but something difference may occur in live trade. All broker can rise their stoplevel and if the stoplevel become the highest then our signal filter or MyOwnTarget, then the target become meaningless. But still it is useful when somehow you loose connection to your Server. Although it is possible to tell EA to set the target every tick or bar, but I decide to let EA doing this thing just when new position is taken. But still the EA will force to give fixed target when it failed in the first attempt. Therefore each position will has difference fixed target.

Another possible problem is the freeze level. This is happened when the expert tries to close an open position while its target is very close with market’s price.

To disabled this feature, then you can set the VISIBLETP variable with FALSE, because I let the default value with TRUE.

You can see my MT4stats; the trades on EURGBP have a fixed target and one of them get hit.

Showing the Target

Showing the Target

What I see if price make up down move within 6 pips will make EA react and often EA will get requote. After make several test finally I can add this feature to VS_EUROCROSS without affecting all the exit rules.

POSSIBLE PROBLEM IN LIVE TRADE

Although backtest show there is no much difference when using fixed target (I am not sure but its looked better), but something difference may occur in live trade. All broker can rise their stoplevel and if the stoplevel become the highest then our signal filter or MyOwnTarget, then the target become meaningless. But still it is useful when somehow you loose connection to your Server. Although it is possible to tell EA to set the target every tick or bar, but I decide to let EA doing this thing just when new position is taken. But still the EA will force to give fixed target when it failed in the first attempt. Therefore each position will has difference fixed target.

Another possible problem is the freeze level. This is happened when the expert tries to close an open position while its target is very close with market’s price.

To disabled this feature, then you can set the VISIBLETP variable with FALSE, because I let the default value with TRUE.

You can see my MT4stats; the trades on EURGBP have a fixed target and one of them get hit.

Showing the Target

Showing the Target

Label:

External Variable,

problem,

VS_EUROCROSS

Monday, July 13, 2009

May be I Will Add New Indicator

I get an indicator that may be i will use it in all my Volatily Scalp EA. Actually I have tested this indicator at the same time with ATR Mod indicator. But i decide not including this indicator in VS_EUROCROSS_D04 and only introducing the use of ATR Mod indicator.

If using ATR Mod tend to trade earlier, in the other hand using this indicator will make our trades will be triggered later. Probably by using this indicator will reduce the dependency of making averaging. But its still earlier to take conclusion because i still make some backtest before deciding to use it or not.

Without New Indicator

Without New Indicator

With New Indicator

With New Indicator

If using ATR Mod tend to trade earlier, in the other hand using this indicator will make our trades will be triggered later. Probably by using this indicator will reduce the dependency of making averaging. But its still earlier to take conclusion because i still make some backtest before deciding to use it or not.

Without New Indicator

Without New Indicator With New Indicator

With New Indicator

Label:

VS_EUROCROSS

Wednesday, July 8, 2009

The Idea Behind VS_EURCHF

I try to trace back my VS_EURCHF_D01source including any note during developing this EA. One you should know, that my first time I made Volatily-Scalp EA to trade EURUSD pair. And VS_EURCHF_D01 is an improvement of Volatily-Scalp General Version.

Early I don't use Keltner Channel, but I use an envelop indicator. I switch from using fixed envelop to use Keltner channel because it has a flexibility to switch to any time frame.

But i get surprised when I test it on several pair, it can make profit without any modification in the code. You can see the screenshot on the manual. But the best result is coming from EURCHF, and for this reason i give the version name VS_EURCHF_d01. And because during developing this EA, the spread on Cross pair is widen, I get the idea to use double spread filter as minimum range to execute a trade. First time I don't use this filter because on EURUSD pair spread is not a problem.

I have compare 3 source, PIPTURBO, VS_EURCHF_D01 crack, and I think the link above is the source that I compiled in VS_EURCHF_D01 package file.

Early I don't use Keltner Channel, but I use an envelop indicator. I switch from using fixed envelop to use Keltner channel because it has a flexibility to switch to any time frame.

But i get surprised when I test it on several pair, it can make profit without any modification in the code. You can see the screenshot on the manual. But the best result is coming from EURCHF, and for this reason i give the version name VS_EURCHF_d01. And because during developing this EA, the spread on Cross pair is widen, I get the idea to use double spread filter as minimum range to execute a trade. First time I don't use this filter because on EURUSD pair spread is not a problem.

I have compare 3 source, PIPTURBO, VS_EURCHF_D01 crack, and I think the link above is the source that I compiled in VS_EURCHF_D01 package file.

Label:

vs_eurchf

Tuesday, July 7, 2009

PIPTURBO, SELLING FREE EXPERT ADVISOR TO PUBLIC

I receive an email from someone who sell PIPTURBO. Here said in his email:

My answer, "I am sorry we can't make that agreement".

I receive donation and letting people buy that something they can get it for free? No thanks. You don't have to apologize. But let people know what PIPTURBO is.

I am the one selling Pipturbo. Unfortunately it seems an incident has come up, please let me clarify and offer you some gratification.

I paid an EA developer to build me a solid EA that could backtest and forward test well on atleast 5 popular currency pairs. I wanted it to have lots of features and customization opportunity. Well, what he gave me seems to have been either sourced extremely well off your ea VS_EURCHF or he basically just copied it and changed a few things here and there.

Regardless, it is clearly a big mistake and I am trying to get a hold of the guy that did this to me, but so far no answer from him.

But I am willing to offer you a donation in exchange for selling this slightly modified version of your EA and removing all negative posts about Pipturbo being a clone.

If you agree, I would be willing to donate you $xxx.

Again, I apologize for this, I should have done better background checks before hiring someone to do this kind of work. I hope we can make an agreement about this.

My answer, "I am sorry we can't make that agreement".

I receive donation and letting people buy that something they can get it for free? No thanks. You don't have to apologize. But let people know what PIPTURBO is.

Label:

vs_eurchf

Sunday, July 5, 2009

PIPTURBO, IS A CLONING OF VS_EURCHF_D01 ?

A new commercial Expert Advisor is releasing during this week and its name PIPTURBO. It is really new, because when I visit their official site and there is nothing out there except their home page. But I find something an interesting when I visited a site that reviews about PIPTURBO http://forex-naked-truth.com/pipturbo_review.html. Here is their statement:

I don’t mind if they create this expert from the scratch. It’s possible because all VS_EURCHF logic is explained in the manual. If really they make it from the scratch, and state that it is an EA that base on VS_EURCHF manual, then I am glad to recommend any my visitor to buy this Expert as an improvement of VS_EURCHF. But it’s sad if they just crack any free ea, repackage and then sell it to public.

PipTurbo also offers many trading filters that will prevent the ea from trading if certain conditions are or are not met. Some of these are very important and most users will wish they were implemented in ever EA they try.

Time Based Filters:

- Because most of the conditions occur at the closing of American’s Market to Asian’s Session, PipTurbo will include a Time Based Filter.

- Trade time only 21-0 GMT general for all pair. A larger time frame can be used like 21-4 but backtests will show fewer losses if kept at the 21-0 timeframe.

- No trades during the first 2 hours on Mondays. Many surprise moves here.

- No trades on Friday after 8 GMT.

- No trades from 20th of December to the end of the first week of the new year as this is one of the worst periods to trade.

Daily filters:

- No trades if the previous Daily close was above/below 2 deviations of Bollinger Bands.

You can avoid this rule to set TradeOutSideBand’s value to TRUE.

- No trades if current 5 Period of Daily Chart showing above MaxDayAtr.

- No trades if the previous days range is too low. Too low is defined as (yesterday high – yesterday low) is less than the current 5 day ATR. You can avoid this rule by setting TradeLowRangeDay value to TRUE.

I don’t mind if they create this expert from the scratch. It’s possible because all VS_EURCHF logic is explained in the manual. If really they make it from the scratch, and state that it is an EA that base on VS_EURCHF manual, then I am glad to recommend any my visitor to buy this Expert as an improvement of VS_EURCHF. But it’s sad if they just crack any free ea, repackage and then sell it to public.

Label:

vs_eurchf

Friday, July 3, 2009

Trade in the right time and the right size

Since d04 I make forward test with 2 instances of VS_Eurocross on EUR/CHF pair with difference time trading set. It is just another way to optimize my system instead of changing any possible variable. I still try to build a version that can run with several time set at once with difference risk, Money Management and maximum trade. What the lack of Meta Trader platform that we can perform a back test with more then 1 system in single account. So we must combine all system in a single EA to perform such test.

Perhaps by doing this test, it can help us to decide when to put our risk at maximum value, and when we must trade with low risk. Putting risk on the right size is not easy task. Although there are some money management strategy but not every system can match with those formulas.

I post the trades of the trading from last night and seem if trading time 19-05 is worse in this case, it hold trade longer and get less pip.

Open Hour 19

Open Hour 19

Open Hour 22

Open Hour 22

On both picture you see also why I am not recomending to run more then 1 expert at a terminal. You can see the spike, once expert can get 2 trades while the other just a single trade. No matter how good your PC and the realibility of your internet connectivity, all expert advisor that run in a terminal, is executed in a single Thread. You can search in google what the term of Thread meaning in programming. But what I know that if an EA is executing its order, then the other's expert on the same terminal must wait to execute their order.

Perhaps by doing this test, it can help us to decide when to put our risk at maximum value, and when we must trade with low risk. Putting risk on the right size is not easy task. Although there are some money management strategy but not every system can match with those formulas.

I post the trades of the trading from last night and seem if trading time 19-05 is worse in this case, it hold trade longer and get less pip.

Open Hour 19

Open Hour 19 Open Hour 22

Open Hour 22On both picture you see also why I am not recomending to run more then 1 expert at a terminal. You can see the spike, once expert can get 2 trades while the other just a single trade. No matter how good your PC and the realibility of your internet connectivity, all expert advisor that run in a terminal, is executed in a single Thread. You can search in google what the term of Thread meaning in programming. But what I know that if an EA is executing its order, then the other's expert on the same terminal must wait to execute their order.

Label:

VOLATILY SCALP

Sunday, June 28, 2009

VS_EUROCROSS_D04 Now Available

A month has been passed, and it is time for VS_EUROCROSS_D04. Again there is no any change in the main system, except adding expiration as usual. But since this version I decide to allow the EA using built in ATR or custom ATR. And other thing it is now using ECN style.

There are new External Variables in this version:

int Margin = 100;

This is Money Management feature that allow you to set the percentage of your balance in case you run several EA at the same time. For example if you have 10 K in your balance, you can tell the EA just to use 20 percent from your balance before calculating the risk.

Bool UseAtrMod = false;

This is the variable that you have to try. If you set it false then it just like previous version. But make sure you use the historical data from your broker before testing this variable.

As my last post before, I try to optimize this EA to work earlier then its default trading time. What the setting that I use with D03 version in the backtest are:

OpenHour=19;

CloseHour=23;

UseAtrMod=true;

MyOwnTarget=5;

There are new External Variables in this version:

int Margin = 100;

This is Money Management feature that allow you to set the percentage of your balance in case you run several EA at the same time. For example if you have 10 K in your balance, you can tell the EA just to use 20 percent from your balance before calculating the risk.

Bool UseAtrMod = false;

This is the variable that you have to try. If you set it false then it just like previous version. But make sure you use the historical data from your broker before testing this variable.

As my last post before, I try to optimize this EA to work earlier then its default trading time. What the setting that I use with D03 version in the backtest are:

OpenHour=19;

CloseHour=23;

UseAtrMod=true;

MyOwnTarget=5;

Label:

External Variable,

VS_EUROCROSS

Saturday, June 27, 2009

IMPROVING VS_EUROCROSS

I make a lot experiment during this week with VS_EUROCROSS before updating its expiration time. I try to change the Simple Moving Average with another MA type such as Exponential MA and Linear Weighted MA for building Keltner Channel Indicator. I also change the Average True Range calculation by using same averaging method. Thus I have Keltner Channel indicator with more flexibility in averaging mode. I put both indicators in the same chart and you can see the difference even with the new Indicator I use Simple Moving Average to calculate the Average True Range. The blue channel is 20 period Keltner Channel using customs ATR.

BUILT IN INDICATOR VERSUS CUSTOM INDICATOR

BUILT IN INDICATOR VERSUS CUSTOM INDICATOR

This chart is using Tadawul platform. If we look the chart should be more trade if we use new Keltner Channel Indicator then previous one. In Alpari, using this new Indicator doesn’t make any improvement (worse) with default trading time. But if I change trading time with open Hour 19 and close Hour 23, Using VS_EUROCROSS_D03 you can see the result.

VS_EUROCROSS_D03 with custom ATR

VS_EUROCROSS_D03 with custom ATR

But it is still worse. Because my experiment it made more profit with less trades.

Less trades with bigger profit

Less trades with bigger profit

And with same setting on EurGbp

And with same setting on EurGbp

Perhaps next time we can have 2 trading time set and give difference risk, other thing that mostly spread during 19-23 time is still low.

BUILT IN INDICATOR VERSUS CUSTOM INDICATOR

BUILT IN INDICATOR VERSUS CUSTOM INDICATORThis chart is using Tadawul platform. If we look the chart should be more trade if we use new Keltner Channel Indicator then previous one. In Alpari, using this new Indicator doesn’t make any improvement (worse) with default trading time. But if I change trading time with open Hour 19 and close Hour 23, Using VS_EUROCROSS_D03 you can see the result.

VS_EUROCROSS_D03 with custom ATR

VS_EUROCROSS_D03 with custom ATRBut it is still worse. Because my experiment it made more profit with less trades.

Less trades with bigger profit

Less trades with bigger profit And with same setting on EurGbp

And with same setting on EurGbpPerhaps next time we can have 2 trading time set and give difference risk, other thing that mostly spread during 19-23 time is still low.

Label:

VS_EUROCROSS

Risk Warning

Please note that Trading in the Foreign Exchange market might carry potential rewards, but also potential risks. You must be aware of the risks and are willing to accept them in order to trade in the foreign exchange market. Don't trade with money you can't afford to lose.