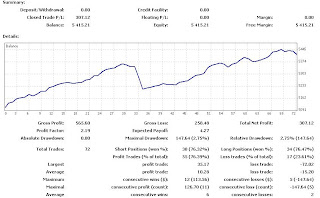

This week begins with the loss derived from Eurgpb pair. But in the end these losses can be covered and still make a profit, although not as the previous week. The question whether any good results will be followed by the opposite result?

Apart from that, EA's performance was good overall, including new EA that run on USDCAD this week.

Determining Lot size

Along with the increasing number of pairs that use, the determination of risk for each pair and the EA becomes a problem. For the moment I tend to use fixed lot for EA that run on the major pairs. As for cross pair I use a fixed ratio. But from my observation, it is rarely a pair makes big profits for 2 successive days. Exceptions occur in 2 weeks ago in which a constant EURGBP pair produce a better profit than the other pair. But generally, every day the pair will produce more profit will be different.

Change lot size every day based on the performance of previous day might be an interesting idea. Since I tried VS_EurChf these characteristics have become my thought.

At the end, maybe we should learn about the z score, a statistical method to determine if there are dependencies or correlation among all our trades.

0 komentar:

Post a Comment