In this section I will explain the parameters of the indicators that are used by VS_Pipscola. So, if you want to optimize the parameters of vs_pipscola, hopefully this explanation can help you.

VS_PipsCola is an EA that works on 15 Minutes Chart. However, it actually observe H1 Time Frame to determine market conditions. Market conditions are determined based on the observations on CK_Speed, ATR, Keltner Channel and parabolic sar indicator. As for putting a more precise entry, EA observe a smaller time frame. Although the observe several time frames, but it use the same length period of CK_Speed, ATR, and Keltner Channel in all time frames observed by the EA. Besides, the EA also allows averaging system.

Here is an explanation of the parameters of VS_PipsCola associated with trading system.

double MasterPeriod = 5; This is the length period used by ATR, Keltner Channel and CK_Speed Indicator on all time frames observed by EA. The use of a single parameter is to facilitate you in doing optimization.

Because EA observes H1 Time Frame, I think this value should not be too big. If you want to do the optimization, I think the minimum value is 3 and the maximum value is 8.

double MaximumAtr = 45; This is similar to filter MaxDayAtr on vs_eurchf. Only VS_Eurchf using D1 Time Frame while VS_PipsCola use H1 Time Frame . The lower you set this parameter value, then a few transactions that may occur. We recommend that you set the value of this parameter refers to the stop losses you want to use. This means that the value of your stop losses should not be below the value of this parameter.

double H1InitialDev = 0.1; This parameter is used to adjust the deviation of Keltner Channel on H1 time frame. The larger the value of this variable the more difficult to place a trade.

double M15InitialDev1 = 0.8;

double M15InitialDev2 = 0.8;The two variables above are used to adjust the deviation of Keltner Channel on the 15 Time Frame. PipsCola EA actually can be arranged to use a different deviation based on market condition. But if you want EA always uses the same deviation, then the two variables must be equal. Since these variables set the deviation of the Keltner Channel, so the smaller the value of these variables will make EA more aggressive.

If you optimize these variables, then the maximum possible results would be obtained if you set a value of M15InitialDev1 less than M15InitialDev2. While the optimal value of the two variables is likely to lie between 0.5 to 1

int MinRange = 5; parameter is similar to the one owned by vs_eurocross. It set the minimum distance between price and moving average. And the rule is clear, the value of this parameter is greater than the Spread + 1.

double MinRangePerTrade = 10; If EA is allowed to take more than 1 same position, then this parameter will set the minimum distance between the same trade position.

int MaxTradePerBar = 1; this parameter to set how many open positions that may be taken on every bar. I said open position, because although the value of this parameter is 1, the EA may transact more than 1 per bar. Suppose that EA took a position and then close the position in the same bar, so if there is a new signal EA will continue to execute the signal.

But despite it all, this parameter can make EA become more aggressive even if you do not optimize the other parameters.

bool AllowHedging = true; this parameter to set whether the EA could take 2 opposite positions (buy and sell). Of course this is closely related to the regulation that is used by each broker.

bool UseSecondaryPeriod = false;

double SecondaryPeriod = 3;I deliberately wanted to explain these variables just in the last section. This is because you can ignore these two variables. But if you are curious, then this is actually the second Keltnert channel observed by the EA in the H1 time frame. You can optimize this parameter. But you have to adjust the UseSecondaryPeriod with True.And another thing if you manage to set SecondariPeriod at 5, means not to change anything, because it has the same length period of MasterPeriod. It is highly experimental, so please try it yourself. Although in my opinion the value of this parameter is only optimal if less than MasterPeriod, but I never optimize it.

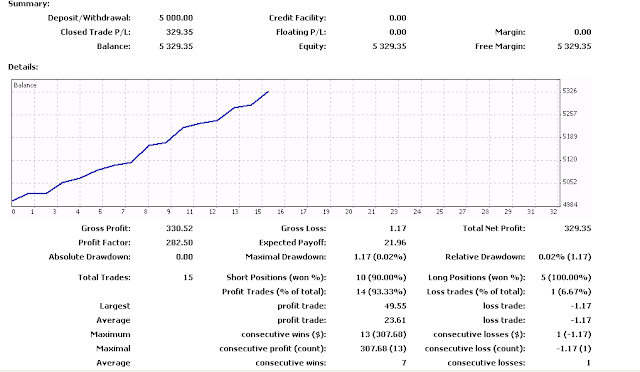

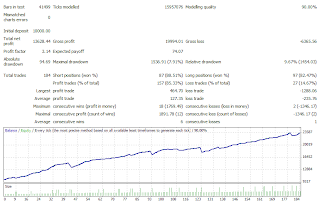

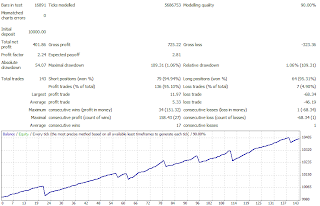

PipsCola USDJPY 2009

PipsCola USDJPY 2009 PipsCola USDCHF 2009

PipsCola USDCHF 2009 PipsCola GBPUSD 2009

PipsCola GBPUSD 2009

Professional Account

Professional Account Standard Account

Standard Account

without scaling out

without scaling out Using Scaling Out

Using Scaling Out Scalping System

Scalping System Detailed Statement 19 - 4

Detailed Statement 19 - 4

trading time 21-0

trading time 21-0 Trading Time 21-23

Trading Time 21-23 Trading Time 23-1

Trading Time 23-1