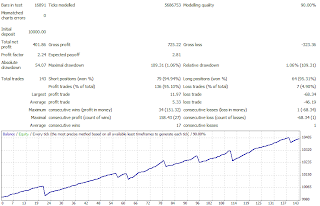

I will show the detailed statement of the results of my test on my previous post.

You can notice that the detailed statement only provides general information about the profit / loss. But consider the following picture. This journal is a place where an EA can write down it's activities.

Profit hari 4: 82 Los hari 4: 15 sumprofit: -138.42

What does it mean? EA to report profit / loss based on the Day(Hari). Profitable trades on the 4th day (Thursday) is 82 (trades), while losses is 15 (trades). And Net Profit is -138.42 ($).

Profit Jam 23: 37 Los Jam 23: 0 sumprofit: 190.39

What does it mean? EA to report profit / loss hourly. Profit for all trading at 23 is 37(trades). And losses for all trading at 23(trades) is 0. And net profit for all trading at 23 is 190.39 ($).

So just based on the above information I could find out that I will get optimal results if I restrict trading time at around 21 to 1. But you are wrong if you guessed that the backtest results from 21 to 1 will be the same if you add up the net profit from 21 to 1. From the reports mentioned above, only one is for sure, that I was not allowed to start trading at 19! For more details, let you see the following picture:

n backtest I did, I set the EA only took one trade for each position. While EA could have produced more than a signal at a certain period. From the above picture there are 5 trades that generate profit (1 trade per hour), but on my backtest, the EA is only allowed to take a trade for each position.

n backtest I did, I set the EA only took one trade for each position. While EA could have produced more than a signal at a certain period. From the above picture there are 5 trades that generate profit (1 trade per hour), but on my backtest, the EA is only allowed to take a trade for each position.But anyway, for me the above approach is sufficient for my EA. Based on reports from my journal, i perform 3 backtest with different periods, but all of them lie between 21 and 1.

You can download the function that i used to create hourly/daily detailed statement. There are only 2 functions in text file, deinit() and Analyze().Moreover it just loop from 19 to 6.

Maybe you can make it better, and have a more brilliant idea. Every trading system has a different characteristics. What I would like to make is how to get the optimal value of a variable without any optimization. Or at least when designing an EA, we can create a report that is more detailed and rich information on trading results.

Detailed Statement 19 - 4

Detailed Statement 19 - 4 trading time 21-0

trading time 21-0 Trading Time 21-23

Trading Time 21-23 Trading Time 23-1

Trading Time 23-1

0 komentar:

Post a Comment