It could be said that I include the Parabolic Sar indicator in all the EA that I made today. And although generally parabolic sar is used as trailing stop as well as stop and reversal system, we actually can use it in another perspective. This is what I get when I learned about Fibonacci lines. I am very confused where to place the swing high and swing low. To make it a mechanical system, there must be clarity where to put those lines.

If we observe any signal change indicated by the Parabolic Sar, then it could be a clue where we put the Swing High / Low Swing of the Fibonacci lines. If you set the parabolic step with the value 0.002, then you will get a good starting point for putting your Fibonacci lines. Place the Swing High / Swing Low right at the signal changes of the Parabolic Sar. If the Parabolic Sar change it’s direction from sell signal to buy signal, it means you should place swing low at the first dot of Parabolic Sar. Actually it is the same whether you place it at the lowest prices that occurred in the previous signal. Now to put the swing high is easy, you just follow the price movements while the Parabolic Sar is still giving buy signals.

But that's just my way to reinforce where to put Fibonacci lines. As a tool, anyone can use an indicator with a variety of ways and interpretation. So, how about to scalp using these indicators? I have no idea.

Sunday, October 24, 2010

Parabolic SAR and Fibonacci Lines

Sunday, October 17, 2010

Forward Test Result and Manage Account

This week I was able to publish the results of Charlotte2 forward test. Actually you can already see the results since a few days ago. Since I've put a link to the publisher the right of this blog. But it's running on the Demo Account at Alpari. While I should post it manually what running on real accounts. In the next few days, I will publish automatically statement of real account with respect to the performance of my VPS.

On average, each account has only 2 deals on this week. But at least this is better than earlier versions. Especially if you see that EA is only working 3 hours a day and 4 days a week. Yes, just 4 days a week, because EA does not work at the opening of trade and the end of the week. But configuration error occurs on account of real trade, I forgot that trade on forex.com broker starts an hour earlier than Alpari. And I forgot to adjust the parameters that govern it. This allows the EA to trade for 1 hour in early trading. But fortunately the transaction is not fatal although almost touching the position of stop losses.

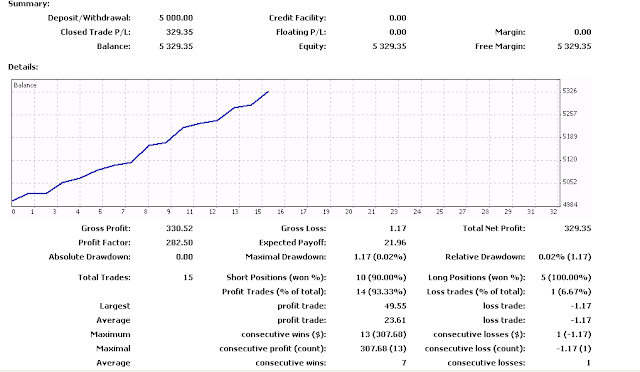

You can see the results of forward test of the demo accounts on my MT4 stats. And for a real account you can see in the picture below. You can compare it to the results of last week.

I also want to give the opportunity for some people who want to invest in FOREX using charlotte to contact me at ch1qho@gmail.com. Before I could decide when and how charlotte later published, then Manage Account only alternative I can give at this time.

And for traders who have registered in the broker Alpari through my affiliate link, I will give a free service Manage Account of any type of account you have.

Happy weekend

On average, each account has only 2 deals on this week. But at least this is better than earlier versions. Especially if you see that EA is only working 3 hours a day and 4 days a week. Yes, just 4 days a week, because EA does not work at the opening of trade and the end of the week. But configuration error occurs on account of real trade, I forgot that trade on forex.com broker starts an hour earlier than Alpari. And I forgot to adjust the parameters that govern it. This allows the EA to trade for 1 hour in early trading. But fortunately the transaction is not fatal although almost touching the position of stop losses.

You can see the results of forward test of the demo accounts on my MT4 stats. And for a real account you can see in the picture below. You can compare it to the results of last week.

I also want to give the opportunity for some people who want to invest in FOREX using charlotte to contact me at ch1qho@gmail.com. Before I could decide when and how charlotte later published, then Manage Account only alternative I can give at this time.

And for traders who have registered in the broker Alpari through my affiliate link, I will give a free service Manage Account of any type of account you have.

Happy weekend

Label:

charlotte

Wednesday, October 13, 2010

Trailing Stop

Do not let a profit turn into losses. This is a principal in trading system that we often hear from the master trading. If prices move in accordance with our position, use a trailing stop or put our stop losses in the break event point. So if you already have a profit of 10 pips, quickly activate the trailing stop. What happens then prices turned direction and touches your stop losses kicking you out, then turned again in accordance with your position and this time the price moves fast. Ho .. ho .. ho. if I were near you that time, believe me I would also go as fast as possible.

Trailing Stop With Fractal and Bar High-Low

There is a change from a trailing stop method that I use this time(Charlotte). Previously I used the Keltner Channel, so this time I use 2 Fractal and the latest 2 Bar as stop losses. But I still use Keltner Channel as a guide to do the trailing, only the position of stop losses are no longer on the Keltner Channel itself.

In order to obtain the position of stop losses I compare the highest / lowest price of the last two fractal. I compare this price again with the last 2 bars. I use the last 2 Bar considering the highest / lowest price could be in one of this Bar. Trailing stop itself is activated when the price penetrates the Upper / Lower channel of Keltner Channel indicator.

The principle I want to reduce the risk in trading. While difficult to make a profit, then we better think about how to reduce losses. And trailing stop this is one way to reduce the risk of each transaction.

Trailing Stop With Fractal and Bar High-Low

There is a change from a trailing stop method that I use this time(Charlotte). Previously I used the Keltner Channel, so this time I use 2 Fractal and the latest 2 Bar as stop losses. But I still use Keltner Channel as a guide to do the trailing, only the position of stop losses are no longer on the Keltner Channel itself.

In order to obtain the position of stop losses I compare the highest / lowest price of the last two fractal. I compare this price again with the last 2 bars. I use the last 2 Bar considering the highest / lowest price could be in one of this Bar. Trailing stop itself is activated when the price penetrates the Upper / Lower channel of Keltner Channel indicator.

The principle I want to reduce the risk in trading. While difficult to make a profit, then we better think about how to reduce losses. And trailing stop this is one way to reduce the risk of each transaction.

Label:

Breakout,

charlotte,

Keltner Channel

Sunday, October 10, 2010

The Forward Test Result

This weekend I had time to post my EA performance in a forward test. Previously I just post my backtest and some ideas of my EA. Forward Test carried out since August 18, 2010 and use 3 accounts, 1 demo account on Alpari as well as 2 live accounts on ForexCom. But this is an early version of my project, which later I improve it as an intermediate term system EA. In the process, EA is already upgraded once. And there is one advantage of this EA, it was able to transact from at 19 to 23. But the problem with the ability to work longer, not followed by an adequate amount of transactions. So it makes sense to change the system from scalping system to intermediate system.

I would not be surprised if later on a lot of scalping system that works on USD JPY pair. Moreover, if the system only works after the closing of European and American markets. My test showed at least my EA to make profit in the last 3 years. And here's a surprise, I did not use a filter other than limiting the time to trade. So I just rely on the accuracy of the trading signal. To anticipate the worst conditions, I apply a rigorous risk management. Yes .. I have to regulate how much of losses suffered by the system may in a day. Try to open your MetaTrader, then observe the movement of USDJPY after the closure of European markets in the last 2 years!

I'm hoping one of the variants of this EA can be used for free via this blog. But it really depends on the outcome of our conversation later. Because maybe if you are interested to try this EA, I am afraid you will be hard to get it.

Well here I show the Detailed statement of my forward test:

Have a Nice Weekend

I would not be surprised if later on a lot of scalping system that works on USD JPY pair. Moreover, if the system only works after the closing of European and American markets. My test showed at least my EA to make profit in the last 3 years. And here's a surprise, I did not use a filter other than limiting the time to trade. So I just rely on the accuracy of the trading signal. To anticipate the worst conditions, I apply a rigorous risk management. Yes .. I have to regulate how much of losses suffered by the system may in a day. Try to open your MetaTrader, then observe the movement of USDJPY after the closure of European markets in the last 2 years!

I'm hoping one of the variants of this EA can be used for free via this blog. But it really depends on the outcome of our conversation later. Because maybe if you are interested to try this EA, I am afraid you will be hard to get it.

Well here I show the Detailed statement of my forward test:

| ||

| Alpari Demo Account |

|

| Standard Account |

|

| Professional Account |

Wednesday, October 6, 2010

Combining 2 Expert Advisor

I'm making an expert advisor. I call this project Charlotte. Initially I was asked to modify vs_eurocross to work on USDJPY pair. I accept the job, and I began to modify vs_eurocross. In the end, with various modifications I get a pretty good backtest results. Unfortunately, the number of transactions carried out very little. Even stop losses should be set at 100 pips. However, Forward test remain to be done both on demo and live accounts. And the result, just like the backtest, the number of transactions is very small but for the average profit per transaction a little better than vs_eurocross.

Since seeing the results of the first backtest, I already have ideas for changing the character of this EA from scalping system to intermediate term system. The problem I was asked to create a scalping system, but I also do not want to forget this idea. Finally, I trace my code from scratch, and marks the point where I have to separate between scalping system and intermediate system. And finally I was satisfied, because I get 2 pieces of EA as well. And the last step I need to do is merge them back into an EA.

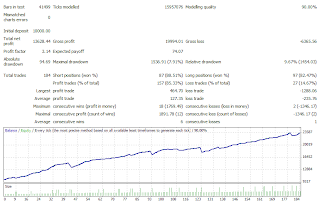

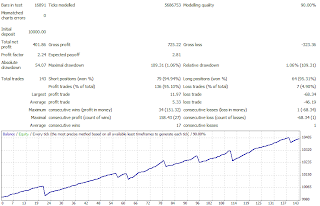

Actually I have shown my backtest results for the scalping system. This time I will show it again, and also compare it with the intermediate term system. I did a backtest from the period January 2009 to August 2010. The spread in my backtest is 2.8, this is the highest spread is given by Alpari for USDJPY pair. While the risk during the backtest period is 10 percent and 60 pip stop losses.

Especially for the intermediate term system, I do backtest 2 times. This is to show the scaling out method that I provide on this system. With the scaling out method, EA will take half of the profit when it has reached half of the target. So let's suppose the profit target is 20 pips, while EA have got profits of 10 pips, then EA would liquidate half of these profits. Both scalping system as well as intermediate-term trading system, just take a position on certain hours. For scalping system I chose to work at 21 to 23. As for the intermediate term, I arranged to work from at 19 to 1. Time zone is not defined, but refers to the broker Alpari.

Especially for the intermediate term system, I do backtest 2 times. This is to show the scaling out method that I provide on this system. With the scaling out method, EA will take half of the profit when it has reached half of the target. So let's suppose the profit target is 20 pips, while EA have got profits of 10 pips, then EA would liquidate half of these profits. Both scalping system as well as intermediate-term trading system, just take a position on certain hours. For scalping system I chose to work at 21 to 23. As for the intermediate term, I arranged to work from at 19 to 1. Time zone is not defined, but refers to the broker Alpari.

There is strong interest for me to combine this system. For the both EA can perform transactions at the same time. Maybe not in the precise timing, but at least still in the same bar. Thus the new strategy can be applied to select the system which would take precedence. Maybe it could produce more, but I myself can not confirm, because until this post I made, the process of merging the two EA has not yet been completed.

Since seeing the results of the first backtest, I already have ideas for changing the character of this EA from scalping system to intermediate term system. The problem I was asked to create a scalping system, but I also do not want to forget this idea. Finally, I trace my code from scratch, and marks the point where I have to separate between scalping system and intermediate system. And finally I was satisfied, because I get 2 pieces of EA as well. And the last step I need to do is merge them back into an EA.

Actually I have shown my backtest results for the scalping system. This time I will show it again, and also compare it with the intermediate term system. I did a backtest from the period January 2009 to August 2010. The spread in my backtest is 2.8, this is the highest spread is given by Alpari for USDJPY pair. While the risk during the backtest period is 10 percent and 60 pip stop losses.

Especially for the intermediate term system, I do backtest 2 times. This is to show the scaling out method that I provide on this system. With the scaling out method, EA will take half of the profit when it has reached half of the target. So let's suppose the profit target is 20 pips, while EA have got profits of 10 pips, then EA would liquidate half of these profits. Both scalping system as well as intermediate-term trading system, just take a position on certain hours. For scalping system I chose to work at 21 to 23. As for the intermediate term, I arranged to work from at 19 to 1. Time zone is not defined, but refers to the broker Alpari.

Especially for the intermediate term system, I do backtest 2 times. This is to show the scaling out method that I provide on this system. With the scaling out method, EA will take half of the profit when it has reached half of the target. So let's suppose the profit target is 20 pips, while EA have got profits of 10 pips, then EA would liquidate half of these profits. Both scalping system as well as intermediate-term trading system, just take a position on certain hours. For scalping system I chose to work at 21 to 23. As for the intermediate term, I arranged to work from at 19 to 1. Time zone is not defined, but refers to the broker Alpari.There is strong interest for me to combine this system. For the both EA can perform transactions at the same time. Maybe not in the precise timing, but at least still in the same bar. Thus the new strategy can be applied to select the system which would take precedence. Maybe it could produce more, but I myself can not confirm, because until this post I made, the process of merging the two EA has not yet been completed.

Monday, October 4, 2010

Finding Optimal Value without Optimization (Part 2 of 2)

In my opinion, lack of MetaTrader is a lack of information we get from the Detailed Statement. Perhaps because of the Detailed Statement of MetaTrader is also used by the broker to send to its customers. Clearly it is enough of the investors, but not for trading system developers. As an illustration, you can observe the MQL championship. At the end of the championship, you can see how they analyze the performance of a trading system. I wish such that report will be in the detailed statement.

I will show the detailed statement of the results of my test on my previous post.

You can notice that the detailed statement only provides general information about the profit / loss. But consider the following picture. This journal is a place where an EA can write down it's activities.

Profit hari 4: 82 Los hari 4: 15 sumprofit: -138.42

What does it mean? EA to report profit / loss based on the Day(Hari). Profitable trades on the 4th day (Thursday) is 82 (trades), while losses is 15 (trades). And Net Profit is -138.42 ($).

Profit Jam 23: 37 Los Jam 23: 0 sumprofit: 190.39

What does it mean? EA to report profit / loss hourly. Profit for all trading at 23 is 37(trades). And losses for all trading at 23(trades) is 0. And net profit for all trading at 23 is 190.39 ($).

So just based on the above information I could find out that I will get optimal results if I restrict trading time at around 21 to 1. But you are wrong if you guessed that the backtest results from 21 to 1 will be the same if you add up the net profit from 21 to 1. From the reports mentioned above, only one is for sure, that I was not allowed to start trading at 19! For more details, let you see the following picture:

n backtest I did, I set the EA only took one trade for each position. While EA could have produced more than a signal at a certain period. From the above picture there are 5 trades that generate profit (1 trade per hour), but on my backtest, the EA is only allowed to take a trade for each position.

n backtest I did, I set the EA only took one trade for each position. While EA could have produced more than a signal at a certain period. From the above picture there are 5 trades that generate profit (1 trade per hour), but on my backtest, the EA is only allowed to take a trade for each position.

But anyway, for me the above approach is sufficient for my EA. Based on reports from my journal, i perform 3 backtest with different periods, but all of them lie between 21 and 1.

You can download the function that i used to create hourly/daily detailed statement. There are only 2 functions in text file, deinit() and Analyze().Moreover it just loop from 19 to 6.

Maybe you can make it better, and have a more brilliant idea. Every trading system has a different characteristics. What I would like to make is how to get the optimal value of a variable without any optimization. Or at least when designing an EA, we can create a report that is more detailed and rich information on trading results.

I will show the detailed statement of the results of my test on my previous post.

You can notice that the detailed statement only provides general information about the profit / loss. But consider the following picture. This journal is a place where an EA can write down it's activities.

Profit hari 4: 82 Los hari 4: 15 sumprofit: -138.42

What does it mean? EA to report profit / loss based on the Day(Hari). Profitable trades on the 4th day (Thursday) is 82 (trades), while losses is 15 (trades). And Net Profit is -138.42 ($).

Profit Jam 23: 37 Los Jam 23: 0 sumprofit: 190.39

What does it mean? EA to report profit / loss hourly. Profit for all trading at 23 is 37(trades). And losses for all trading at 23(trades) is 0. And net profit for all trading at 23 is 190.39 ($).

So just based on the above information I could find out that I will get optimal results if I restrict trading time at around 21 to 1. But you are wrong if you guessed that the backtest results from 21 to 1 will be the same if you add up the net profit from 21 to 1. From the reports mentioned above, only one is for sure, that I was not allowed to start trading at 19! For more details, let you see the following picture:

n backtest I did, I set the EA only took one trade for each position. While EA could have produced more than a signal at a certain period. From the above picture there are 5 trades that generate profit (1 trade per hour), but on my backtest, the EA is only allowed to take a trade for each position.

n backtest I did, I set the EA only took one trade for each position. While EA could have produced more than a signal at a certain period. From the above picture there are 5 trades that generate profit (1 trade per hour), but on my backtest, the EA is only allowed to take a trade for each position.But anyway, for me the above approach is sufficient for my EA. Based on reports from my journal, i perform 3 backtest with different periods, but all of them lie between 21 and 1.

You can download the function that i used to create hourly/daily detailed statement. There are only 2 functions in text file, deinit() and Analyze().Moreover it just loop from 19 to 6.

Maybe you can make it better, and have a more brilliant idea. Every trading system has a different characteristics. What I would like to make is how to get the optimal value of a variable without any optimization. Or at least when designing an EA, we can create a report that is more detailed and rich information on trading results.

Sunday, October 3, 2010

Finding Optimal Value without Optimization (Part 1 of 2)

When a trading system suffered a drawdown phase, mostly what we do is performing optimization on a few variables to make adjustment to market condition. I do not want to debate whether the optimization will guarantee profitability or not. But one thing is for sure, do the optimization would take its own time in making trading system. But depending on a trading system that we make, sometimes there are some variables that we can actually know their optimal value without performing optimization.

In recent months I forced myself to complete an EA who worked on the USDJPY pair. This is based on several requests from my friends who came from Japan, and in general most of the visitors of this blog in recent months came from Japan.

I also get some input on the settings used on my EA, both vs_eurocross or on vs_eurchf. Actually I was a little worried about seeing their courage to use my EA on USDJPY pair, especially if they use vs_eurocross. But despite it all, what my concern is how they do the optimization in several variables, especially the trading time.

Finally I got the idea to create a function that analyzes the trading results as a whole when we make the process of backtesting. I think this should be better if the developer of MetaTrader include this report in a detailed statement. What I want from MetaTrader developer, as appropriate, we can get a detailed statement of profit / loss based on the hours or days. Isn't it interesting one?

Now to see how the script / functions work, I insert this function in the EA that I have just created. Then the functions / scripts will work right when EA completes an backtest. Or in other words, this function will be called from deinit functions in MQL4. As an experiment, I arranged for this EA to work from 19 o'clock until 4 o'clock. I do not want to mention the time zone, but for the record I always use data from Alpari broker. Apart from all the other variables, I do backtest from the period January 2010 to August 2010 and it's equity curve looks like the picture on the following image:

Ah .. I do not think anyone wants to invest his money in the system like this. But maybe the person will change his mind after seeing the optimal value of the trading time that obtained without optimization.

Ah .. I do not think anyone wants to invest his money in the system like this. But maybe the person will change his mind after seeing the optimal value of the trading time that obtained without optimization.

In recent months I forced myself to complete an EA who worked on the USDJPY pair. This is based on several requests from my friends who came from Japan, and in general most of the visitors of this blog in recent months came from Japan.

I also get some input on the settings used on my EA, both vs_eurocross or on vs_eurchf. Actually I was a little worried about seeing their courage to use my EA on USDJPY pair, especially if they use vs_eurocross. But despite it all, what my concern is how they do the optimization in several variables, especially the trading time.

Finally I got the idea to create a function that analyzes the trading results as a whole when we make the process of backtesting. I think this should be better if the developer of MetaTrader include this report in a detailed statement. What I want from MetaTrader developer, as appropriate, we can get a detailed statement of profit / loss based on the hours or days. Isn't it interesting one?

Now to see how the script / functions work, I insert this function in the EA that I have just created. Then the functions / scripts will work right when EA completes an backtest. Or in other words, this function will be called from deinit functions in MQL4. As an experiment, I arranged for this EA to work from 19 o'clock until 4 o'clock. I do not want to mention the time zone, but for the record I always use data from Alpari broker. Apart from all the other variables, I do backtest from the period January 2010 to August 2010 and it's equity curve looks like the picture on the following image:

Ah .. I do not think anyone wants to invest his money in the system like this. But maybe the person will change his mind after seeing the optimal value of the trading time that obtained without optimization.

Ah .. I do not think anyone wants to invest his money in the system like this. But maybe the person will change his mind after seeing the optimal value of the trading time that obtained without optimization.

Risk Warning

Please note that Trading in the Foreign Exchange market might carry potential rewards, but also potential risks. You must be aware of the risks and are willing to accept them in order to trade in the foreign exchange market. Don't trade with money you can't afford to lose.

Professional Account

Professional Account Standard Account

Standard Account without scaling out

without scaling out Using Scaling Out

Using Scaling Out Scalping System

Scalping System Detailed Statement 19 - 4

Detailed Statement 19 - 4 trading time 21-0

trading time 21-0 Trading Time 21-23

Trading Time 21-23 Trading Time 23-1

Trading Time 23-1