Since seeing the results of the first backtest, I already have ideas for changing the character of this EA from scalping system to intermediate term system. The problem I was asked to create a scalping system, but I also do not want to forget this idea. Finally, I trace my code from scratch, and marks the point where I have to separate between scalping system and intermediate system. And finally I was satisfied, because I get 2 pieces of EA as well. And the last step I need to do is merge them back into an EA.

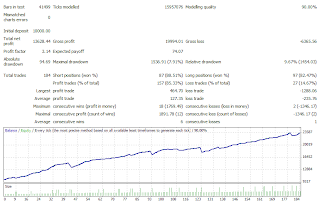

Actually I have shown my backtest results for the scalping system. This time I will show it again, and also compare it with the intermediate term system. I did a backtest from the period January 2009 to August 2010. The spread in my backtest is 2.8, this is the highest spread is given by Alpari for USDJPY pair. While the risk during the backtest period is 10 percent and 60 pip stop losses.

Especially for the intermediate term system, I do backtest 2 times. This is to show the scaling out method that I provide on this system. With the scaling out method, EA will take half of the profit when it has reached half of the target. So let's suppose the profit target is 20 pips, while EA have got profits of 10 pips, then EA would liquidate half of these profits. Both scalping system as well as intermediate-term trading system, just take a position on certain hours. For scalping system I chose to work at 21 to 23. As for the intermediate term, I arranged to work from at 19 to 1. Time zone is not defined, but refers to the broker Alpari.

Especially for the intermediate term system, I do backtest 2 times. This is to show the scaling out method that I provide on this system. With the scaling out method, EA will take half of the profit when it has reached half of the target. So let's suppose the profit target is 20 pips, while EA have got profits of 10 pips, then EA would liquidate half of these profits. Both scalping system as well as intermediate-term trading system, just take a position on certain hours. For scalping system I chose to work at 21 to 23. As for the intermediate term, I arranged to work from at 19 to 1. Time zone is not defined, but refers to the broker Alpari.There is strong interest for me to combine this system. For the both EA can perform transactions at the same time. Maybe not in the precise timing, but at least still in the same bar. Thus the new strategy can be applied to select the system which would take precedence. Maybe it could produce more, but I myself can not confirm, because until this post I made, the process of merging the two EA has not yet been completed.

without scaling out

without scaling out Using Scaling Out

Using Scaling Out Scalping System

Scalping System

0 komentar:

Post a Comment